It’s a known

fact that, on average, women are paid less than men in almost every industry.

That’s something we talk about often—and yet, still not enough—but it brings to mind another question: what are the signs you're being underpaid?! At some point in your career—especially if you're a woman or person of color—you might question whether you're being underpaid.

Another time you might get curious about your salary is when you're job searching and preparing to answer questions about

salary expectations or have been working at the same company/role for multiple years. When you've been in the same role for a number of years you'll want to know how your salary compares to the market rate of a new hire for that same role.

Although job-hopping has been

reported to be a great way to quickly increase your salary, for people who stay in the same role instead of moving jobs every few years, they need to remember that their skills, experience, and accomplishments have increased—and their salary should reflect this growth as well.

But many times companies don't adjust a more tenured employee's salary to match a new hire so they unknowingly continue to be underpaid.

So, what can you do to ensure you're not underpaid? Does being underpaid impact more than just your bank account? And what exactly are some signs you're underpaid and need to consider some

salary negotiation conversations?

In this article, we will discuss it all and provide some strategies on what you can do about it.

Table of Contents

The Psychology of Being Underpaid

Fact: Most Women Think They’re Underpaid

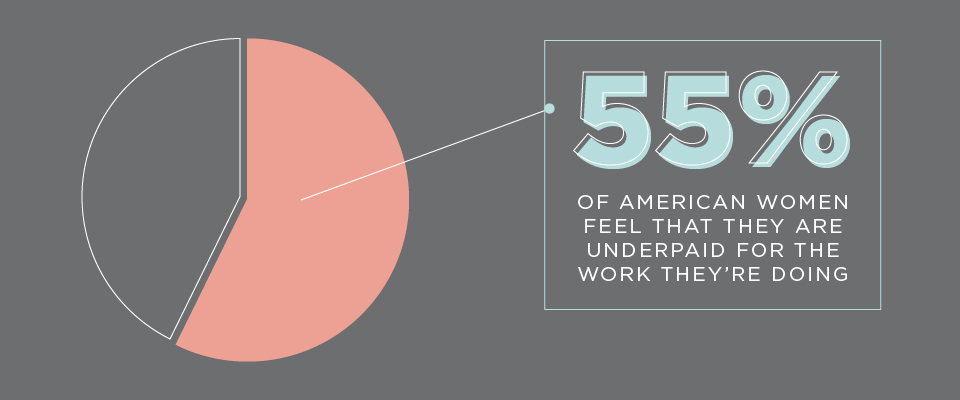

If you’re underpaid—or even think you might be—that feeling can directly and negatively affect how you see yourself professionally. You’re also not alone. A

Gallup poll found that 55% of American women felt that they were underpaid for the work they were doing (compared to 51% of Americans in general).

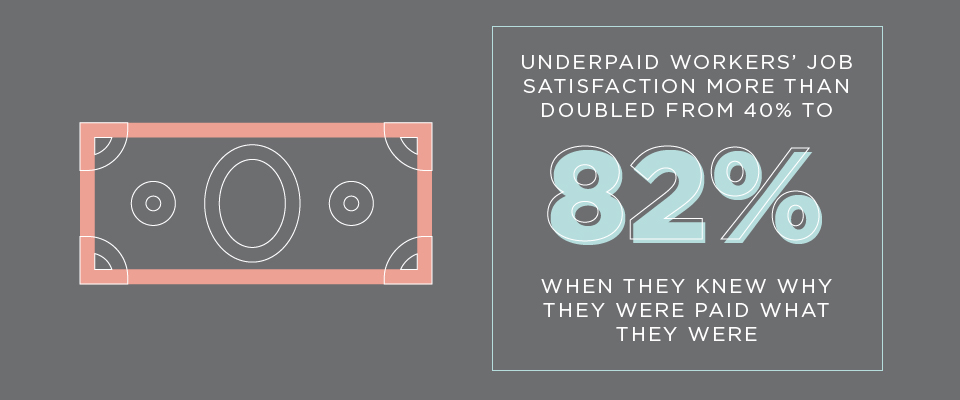

That’s a big problem, considering the

National Bureau of Economic Research found that people feel less satisfied with their work when they feel they’re underpaid. In other words, if you’re currently feeling like you’re not paid what you deserve, you’re less likely to enjoy the work you’re doing—meaning that burnout you might be feeling? It might not be the job at all. It might just be your paycheck.

Feeling Underpaid and Depression Go Hand-in-Hand

We’re not just talking mild dissatisfaction here, either. There are health consequences. An

article in

The Globe and Mail cites studies that show that: “Feeling underpaid doubles the probability that a worker will report experiencing ‘stress, depression, and problems with emotions’ on a majority of days in any given month.”

The article goes on to explain that physical health symptoms arise as well, from headaches to insomnia. Of course, that’s not all that surprising. You know all those studies about how stress affects our physical health. So, if you’re worried about not making enough money to live (or live as well as you’d like), you’re stressed—plain and simple—with all the accompanying side effects.

Sensing You’re Underpaid Also Breeds Resentment

Awhile back, we heard about this great cucumber experiment. Well, turns out that all this harkens back to an experiment with monkeys to test the feeling of being “underpaid,” which it turned up in that same Globe and Mail piece. Here’s how it worked:

Two monkeys performed the same task with the same degree of skill. One monkey received a (mediocre) cucumber, the other a delicious grape. The monkey who didn’t receive a cucumber lost it, banging the cage floor and rattling the cage. It’s natural to react to unequal “pay” with anger and protest—outward or otherwise.

As Globe and Mail puts it: “If monkeys aren't cool with getting less than they deserve, why should we be?”

Ironically, Our Expectation of “Fair” Means We Often Don’t Negotiate

Dr. Robin Pinkley, a management professor at Southern Methodist University’s Cox School of Business and the author of

Get Paid What You're Worth* is quick to point out that while we might think we deserve what’s fair, it also works against us more than we even realize.

Women, in particular, believe that a company will pay them what they deserve based on ability. (Think: they don’t throw the cucumber because they assume the cucumber is what everyone’s getting.) That means they ultimately negotiate less than men, “trusting” the system instead.

Here’s how she explains it:

“Women are less willing to negotiate, and are less assertive than men," says Dr. Pinkley, “They often anticipate that organizations will accurately evaluate their potential, and pay them accordingly. Men, on the other hand, believe that it is up to them to explain to the company what they’re worth.”

That’s exacerbated even more if you’re a millennial woman. According to Pinkley:

“Millennials tend to have a strong focus on fairness, with the notion that resources should be distributed evenly. As a result, making the ask during negotiations is very hard for them.”

The Bottom Line

In addition to being less satisfied at work, depressed, anxious, resentful, and being less willing to negotiate, being underpaid impacts your long-term earning potential—and therefore your overall wealth—and your confidence.

If you think you're being underpaid, you'll want to get to the bottom of that question quickly—and then take action.

27 Signs You're Being Underpaid

Here are 27 signs that can help you determine if you're being fairly compensated.

1. You're an LGBTQ+, Person of Color, Transgender Woman or Man, Cisgender Woman, and/or Non-Binary Individual

If you're not a white man, there is a good chance you're being underpaid.

Wage gaps and economic disparities exist among these groups for a variety of reasons, and we urge you do your own individual research on how big those wage gaps can be.

2. Your Salary Is Lower Than an Online Salary Calculator or Databases Suggest

The calculators typically use aggregated data to give you a ballpark of the salary range for your job type and industry. If you're not even close to the range, you can suspect you might be underpaid.

3. Your Salary Is Lower Than Online Averages

Another way to do salary research is by looking at online averages or even the

compensation listed on open jobs—yes, this is becoming a real thing. If you're looking at these online averages and your salary is less than what's listed as the average, you're probably underpaid.

4. When You Do Salary Research With People in Similar Roles at Other Companies, You're Paid Less

We're big fans of salary transparency, and one of the ways you can learn what the market value is for your role is by talking to people with the same job—or at least very similar.

When you ask them what they make and learn about the scope of their job, is it similar to yours? Or are they being paid more for the same amount of responsibilities?

5. Your Salary Remained the Same—But Your Responsibilities Increased

Especially over the last few years when companies and employees have needed to adapt quickly, there's a chance your responsibilities increased. Maybe that was a department change, you lost a colleague to the great resignation, or something else.

The question remains—if you took on more work and have kept up that new workload without an increase in compensation it's time to consider

asking for a raise.

6. Your Compensation Package and/or Benefits Differ Than Your Colleagues—And Not in a Good Way

Did you just learn your coworker is getting more PTO or better health benefits? Remember that it's not just about salary. You can also be underpaid when someone you work with is getting more benefits including pre-tax benefits which impact how much money you take home.

7. You Know That New Hires in Similar Jobs Are Making More

Whenever a company hires a new person for a role—especially for a role like yours—they are negotiating salary and benefits based on today's market rates. These are probably higher than when you were hired years ago. If you haven't investigated what the salary is for a new hire in your role today, make sure you do that.

8. You Haven't Negotiated a Raise Recently—Or Ever

When's the last time you asked for a raise? And even if you haven't asked for a raise recently, did your employer adjust your annual salary? If neither of these concepts rings a bell to you, you're probably being underpaid.

9. A Recruiter in an Informal Interview Mentioned You're Underpaid

A great resource when it comes to current salaries for specific roles is recruiters. They are hiring new roles all the time and they work closely with compensation analysts to create salary ranges. If you want to know if you're underpaid, try having an informal or even formal interview process and see what you're offered.

10. You've Been in the Same Role for Years—And Never Gotten a Significant Raise

As we mentioned before, companies rarely adjust salaries for tenured employees. They should because it's the right thing to do, but you can't count on that.

If you're been working at a company for 5+ years and have never had a significant salary raise then we urge you to start researching salary ranges for your role. Unfortunately, staying at a company for a long time can reduce your salary runway over the long term.

11. You Haven't Had a Performance Review Recently

Have you been given the opportunity to showcase your growth and achievements at the company recently? If you haven't then it's time to request one and bring up your salary. A lack of performance reviews can indicate your salary has stalled as well.

12. The Company Has Grown—But Your Salary Remained the Same

If the performance of your company has increased and you know it also impacted their revenue, but not your salary, it's time for a conversation.

13. You Learned a New Position at Your Company That Requires Less Experience Pays More

If your company is creating a new role that requires less experience than yours but will be paid more, then you're being underpaid.

14. Jobs Like Yours in the Same Location Are Paying More

Another benefit of salary transparency is networking with people in similar roles but other companies. They can help you determine the average salary for a role like yours—and if they are all being paid more, you'll know you're underpaid pretty quickly.

15. Your Job Is in High Demand and Your Salary Doesn't Reflect That

High-demand jobs can also demand a higher salary. When's the last time you checked out the

job boards to see how popular your current role is?

16. Your Salary Increases Are Not Reflective of Cost of Living Increases

If you were recently given a 2% raise but your rent went up 8%, then your salary increases are not keeping pace with the cost of living increases.

17. Your Salary Increases Are Not Reflective of Recent Inflation Increases

Similar to cost of living adjustments, see how your salary increases are tracking against inflation. You might be underpaid now that inflation is so high.

18. Your Salary Doesn't Reflect Your Specialized Skillset and/or Qualifications

Some industries require niche skillsets and/or years of experience to do the work. If you have a highly specialized career with a unique view that makes you an asset to the company, your salary should reflect that.

19. Your Company Has a High Turnover Rate

How often are your colleagues

resigning? If you know your company has high turnover and is hiring new people to fill those roles, look into how quickly those new roles are being filled. This can tell you two things. First, people left because they felt they were underpaid. Next, people aren't accepting new roles because they aren't getting their

desired salary.

20. You Were Offered a Promotion—But Not a Salary Raise

Did your employer recently offer you a

promotion without a raise? We hate to break it to you, but that's not really a promotion and you deserve the real thing. Taking on a new role with more responsibility should come with a higher salary.

21. You Recently Switched Industries But Your Salary Remained the Same

You're probably underpaid if you recently transitioned into a higher-paying industry but your starting salary didn't change. Even worse, if your starting salary was based on the lower-paying salary in your previous role.

22. You Know Your Coworkers With Similar Experience + Educational Background Make More

Take time to investigate any similarities between your experience and educational credentials and your colleagues'. If you have comparable education degrees, certificates, etc., and professional experiences but your salary pays less than theirs, you might be underpaid.

23. When You Bring Up Pay to Your Boss, They Get Defensive

Reflect on the times you've brought up the topic of salary to your boss. Do they get defensive and try to

gaslight you? Not only are you possibly being underpaid, but your boss is making your doubt your abilities and that is also costing you.

24. You Work in a Toxic Work Environment

Similar to a

bad boss, a

toxic workplace can make you question your worth. Questioning your worth can keep you from asking for a raise or leaving a job when you're underpaid.

25. Your Company Has a Reputation for Paying Lower Wages

Some companies have a reputation for not paying the best but they make up for it with other benefits. Do some research to see if your company has this reputation because it might explain why you're underpaid. From there, you can decide if the benefits are enough or if it's time to look elsewhere.

26. Unemployment Is Low, the Job Market for Employees Is HOT, and Your Company Isn't Addressing Pay

When the job market is hot (like right now), employers are fighting to hire talent. If your current company is shying away from compensation conversations or hasn't addressed your pay, you're probably being underpaid compared to what new roles are offering.

27. Job Boards and Recruiters Are Reaching Out to You More Than Usual

Similar to #26 on this list, when recruiters are actively looking to hire, you can use this as an opportunity to learn what the market values are for your skillset. From there you can evaluate if you want to stay, how much of a raise to ask for, or if it's time to move on.

What to Do If You Suspect You're Underpaid

1. Determine Your Market Value

If you suspect you're underpaid, do some salary research to determine what your market value is. This includes checking out online salary tools, but even better if you can talk to peers in similar roles, industries, and companies. And be sure to talk to other women and men since men—especially white men—are paid more on average.

Make sure you understand the full scope of their role, experience, and what makes up their entire compensation package. Here are some helpful places to start:

2. Negotiate a Raise

Once you have determined your market rate, it's time to decide if you want to stay in your current role. If you do, this means negotiating your salary and/or other benefits to make sure you're no longer underpaid. Here are some resources to help guide you:

3. Launch a Job Search

If you've decided that you're ready to find a new job in order to get the salary you deserve, you'll want to launch a job search. Here are some helpful places to help you quit your old job and land a new, better-paying one.

* This post contains affiliate links.