"I cannot wait to spend half of my income on attending weddings!" said no person in their late twenties to late thirties.

Why does it seem like the *moment* we reach a place of financial stability, a slew of wedding save-the-dates, invites, magnets, and more wrecks us? If our fridge can't handle all of these wedding invitations, how can our bank accounts?

Weddings are expensive. The average cost of being a bridesmaid is roughly $1,500. When you add up the cost of the travel, gifts, bachelorette party, and dress—and multiply it across multiple friends—that is a huge chunk of change.

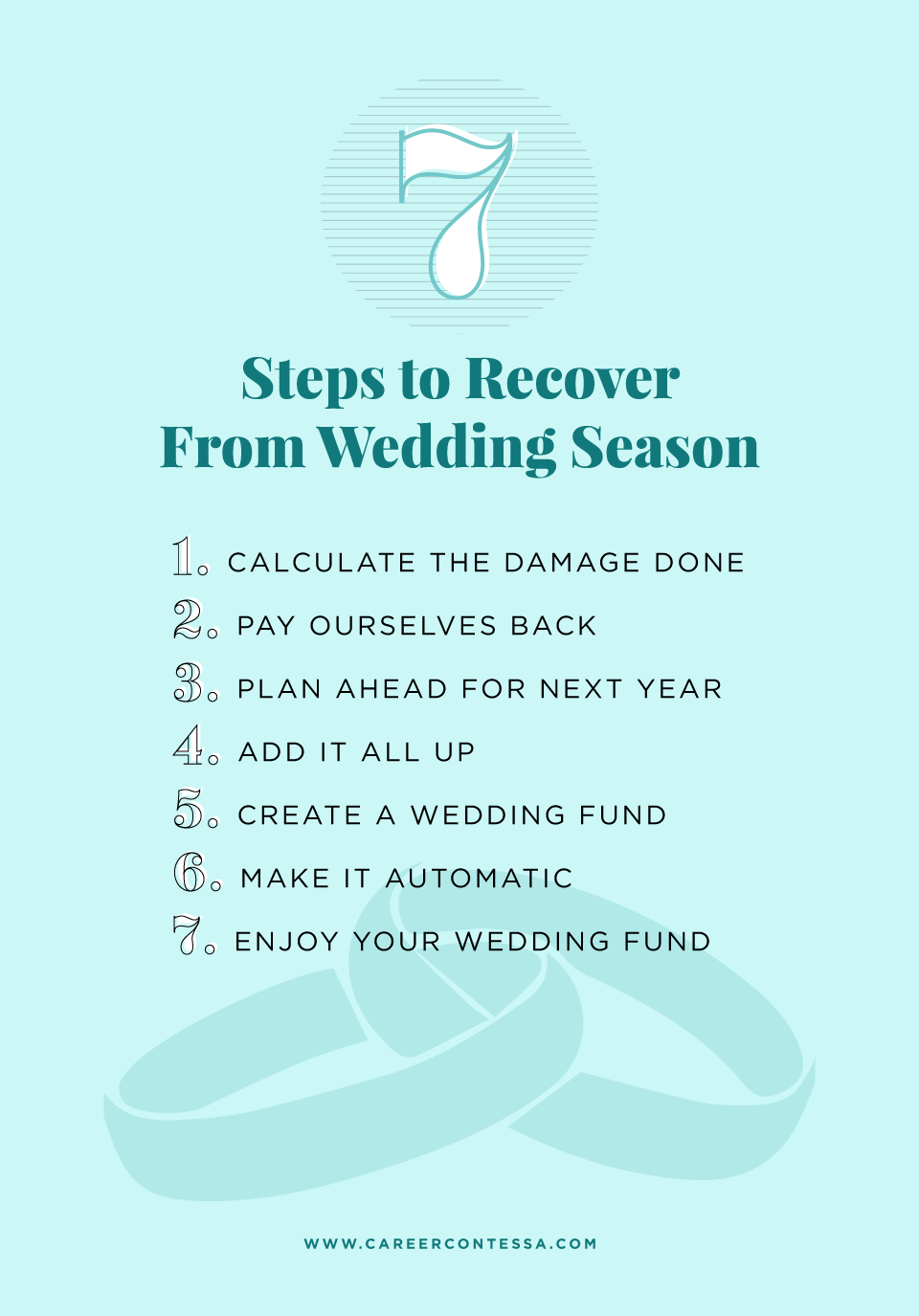

These are big expenses that can hit all in one paycheck and make cash flow tight. If you’re feeling the financial hangover from a banging wedding season, we've outlined seven steps to help you recover. Plus, we've formulated a plan to make the next wedding season go a whole lot more smoothly on your wallet.

We can

grow and improve in our financial lives. Before we dive into the steps, I want to start with this. It might sound like a no brainer, but we can get better at dealing with our money—it's like any other skill.

Just because wedding season took us by storm and demolished our savings, it doesn’t mean we can’t learn from our experiences and plan differently for next time.

You Might Also Like These Articles:

1. Calculate the Damage Done

When we spend more than we plan to, it can seem easier to put our heads in the sand and try to ignore it.

Believe me, I’ve been there! This approach often ends up causing us even more stress and worry because we’re not clear on what we spent and we aren’t sure whether or not we can pay our bills.

I find that many of us believe we’re worse off than we are. It can be really eye-opening and strangely liberating to go back and calculate how much we spent during wedding season. How much of that came from savings or is on a credit card that we’re unable to pay off?

2. Pay Ourselves Back

Regardless of how we covered our wedding season costs, we want to pay ourselves back. It’s a great feeling!

Depending on what your expenses look like and how many things you're saving for, this can take some time—and that’s okay. It doesn’t have to happen right away.

Decide on an amount per paycheck or per month to pay yourself back. Set that up to transfer automatically so you don’t have to think about it. This is a huge gift to yourself, so pat yourself on the back for this one.

3. Plan Ahead for Next Year

Next, we look ahead to the upcoming wedding season and plan in advance. This is some

major financial adulting. The further in advance we plan, the less pain we feel per paycheck.

Think through the next year or so, and list out each wedding you plan to attend. Don’t forget to include bachelorette parties, showers, and ancillary wedding expenses like dresses, transportation, and gifts.

You will have to estimate a lot of these costs, but that’s okay. We just want to use our most realistic guess. If you know someone is going to have a bachelorette party that you want to attend, but you aren’t sure where or when, include a lump sum as a placeholder.

It's better to overestimate than underestimate.

4. Add it All Up

Add up all of your upcoming wedding expenses.

If this number seems unrealistic, you might want to make some adjustments. That might mean saying no to a bachelorette party and throwing your friend a local celebration for just the two of you instead, or it might mean staying at an Airbnb or a friend’s place instead of the wedding hotel.

Have fun and get creative with this! With some creativity, we can create win-win scenarios where we aren’t giving up the things that are important, while still saving money. This is not about restriction or limiting fun.

5. Create a Wedding Fund

Then, we can create a special account for our wedding funds. I am a big fan of

online savings accounts for this because they earn some interest, are free, and are out of sight, out of mind.

6. Make It Automatic

We can then set up an automatic transfer to our wedding fund every paycheck or every month. The simplest way to calculate the amount is to take our annual wedding expenses divided by the number of paychecks we get per year.

For example: if I have $3,000 of expected wedding expenses in the next 12 months, I’d want to set up a transfer of $115 per paycheck ($3,000 divided by 26 paychecks) to my wedding fund automatically.

7. Enjoy Your Wedding Fund

As you pay for wedding expenses, you can transfer the funds over from your wedding account. It is an incredible feeling to have the money waiting there for you when you need it. You can focus on celebrating

without the money stress!