We're all pretty familiar with budgeting, but what does financial forecasting involve?

Whether you’re operating a small business or you’re an entrepreneur, it might be time to set your budget and forecast.

This month, Wightman helps us to create a budget and a forecast for the upcoming year. along with advice on how to keep our eyes on our budget year-round, so that we’re not met with any surprises another 12 months down the line.

Even if you’re not an entrepreneur, read along for great takeaways on managing your personal finances.

First Comes Budget, Then Comes Forecast

A financial forecast is going to act as a framework for what your business could look like in the future—financially-speaking.

Before you get to creating a financial forecast, you’ll want to create your budget. What’s the difference between a budget and a forecast? Simply speaking, your budget comes first. According to our expert, CPA Diane Wightman.

“You need to develop the budget first. Any business should begin with a budget—a zero-based budget in which all expenses are justified and approved for. Once you have a budget, you can then develop your forecast based on what actual results are showing.”

“The primary difference between a budget and a forecast is that a budget lays out the plan for what a business wants to achieve, while a forecast states its actual expectations for results.”

Your business’ budget accounts for fixed costs, estimated revenue, variable costs, cash flow, and profit. Budgets will differ according to your business type. For example, if you have a seasonal business, your budget will provide a view of past and present—it will likely include opportunities to cut costs during slow seasons.

What is a Financial Forecast and Why Do I Need One?

Financial forecasting is not easy—and it can become especially challenging when faced with a changing economy. Typically speaking, entrepreneurs don’t love working on budgets or financial forecasts, especially when they could be spending their time developing, growing, and fundraising for their business.

Unfortunately, many budgets and financial forecasts are created only to be largely ignored until problems arise. That’s why it’s essential to

enlist the help of a CPA to enact consistent bookkeeping.

Preparation is Key

In order to create a good financial forecast, small business owners or entrepreneurs should work closely with a CPA to create projected financial statements or Pro Forma Income Statements.

These statements will give you, as a business owner, a view of what your financials look like—including revenue projections, market assumptions, costs, and estimated cash flow.

Another way to prepare a good financial forecast is actually by preparing several. Every business owner wants to create an optimistic financial forecast—one that shows successful and substantial growth. We’d call this the optimistic forecast. Definitely create this forecast. It’s a great motivator for yourself and your team.

In addition to the optimistic forecast, we would advise you to create a conservative forecast, as well. This forecast will show less growth and potentially more uncertainty. Your conservative forecast will take into account volatile variables like government regulations, unexpected competitions, and economic changes.

Volatile Expenses

Speaking of being prepared, volatile expenses are bound to come up for any small business owner. The best thing to do is to be as prepared as possible to absorb them. To prepare for volatile expenses, Wightman advises,

“Materials and payroll are the most volatile expenses and can vary widely due to circumstances beyond your control. They move at the whim of the market. Budget high so that you are not surprised.”

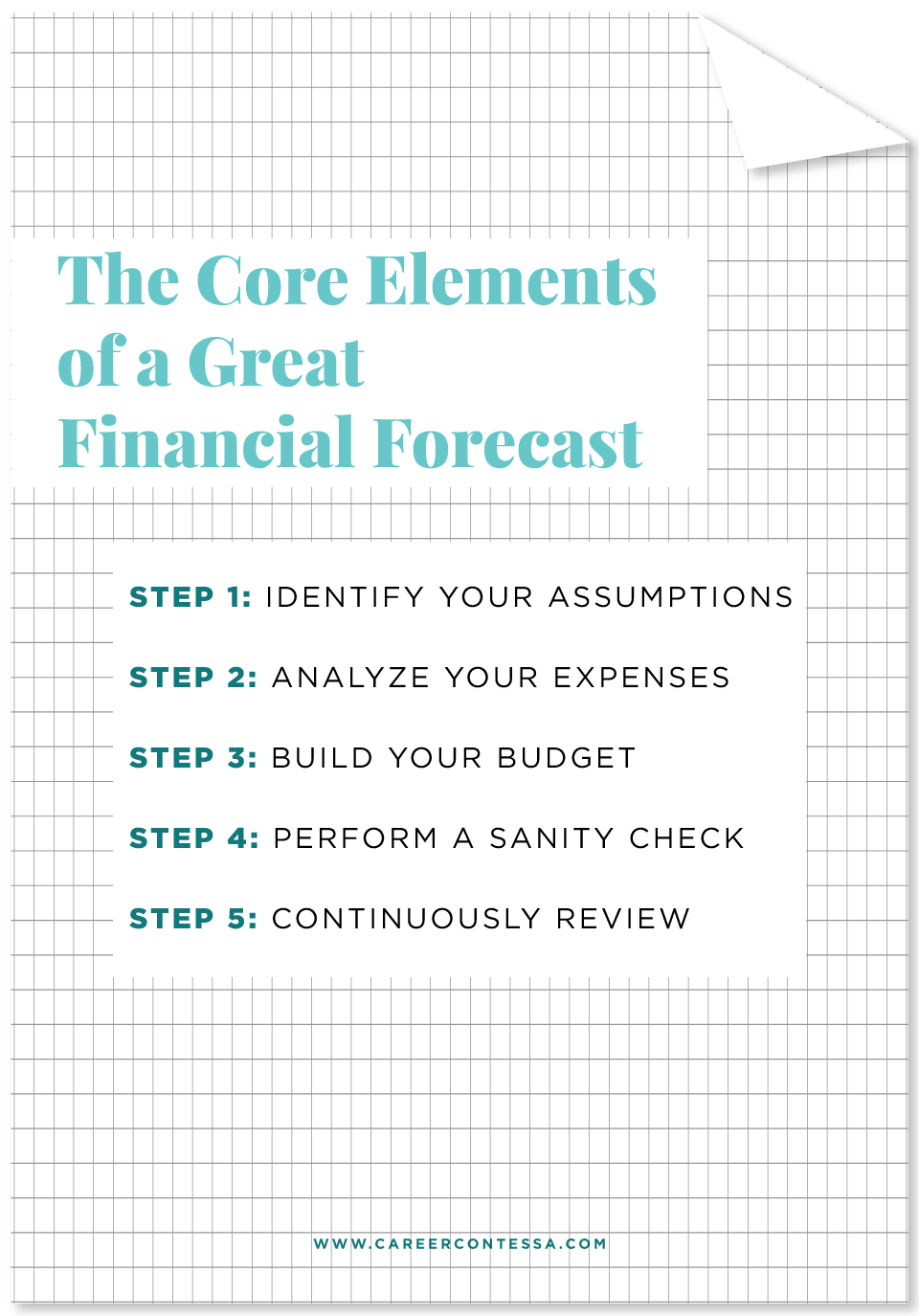

The Core Elements of a Great Financial Forecast

So, how do you actually create a financial forecast to plan for your business’ upcoming year? Here’s a five-step process from our CPA expert, Wightman.

Step One: Identify Your Assumptions

To develop a great financial forecast, begin by identifying and qualifying your assumptions. Ensure that any assumptions are complete, accurate, and current. With the help of a CPA, perform a detailed market analysis. What is happening within your marketplace? Is it growing or declining? Take all of this into account.

Step Two: Analyze Your Expenses

Consider first your fixed costs and expenses. Fixed costs include things like rent, utilities, and insurance payments. Next, tackle your more variable costs. Variable costs include expenses that vary due to production or demand—they can include materials, labor, and shipping.

Step Three: Build Your Budget

With a comprehensive understanding of your fixed costs and your variable expenditures, you can begin to build your revenue budget.

Step Four: Perform a Sanity Check

Once you’ve created your budget, perform a financial sanity check. Enlist the help of a CPA to review the financial information of comparable companies or competitors. This will give you an added sense of security in your established budget, pricing, and financial forecasting.

Step Five: Continuously Review

You’ve created your budget and you’re done! Well, not quite. Your budget should be continuously reviewed and reworked as necessary. By staying on top of your financial budget and forecasts—whether on a quarterly, monthly, or even a weekly basis—gives you a consistent view of what’s going on. Don’t underestimate the importance of this 360-degree knowledge of your business financials.

If it’s time to create a budget and financial forecast for your business, find the best CPA for your needs. The American Institute of Certified Public Accountants’

Find-A-CPA map will help you find the right CPA for your needs in your area.

Happy Budgeting + Forecasting!