Asking for a raise at work is far from casual. It’s probably one of the most nerve-racking conversations you’ve ever prepared for.

And it's no surprise. Societally, we're taught that talking about

money is taboo. In fact, a

study by Payscale found that only 37 percent of respondents reported asking for a raise at some point in their career.

We need to work on our money-talking muscles—and we have to overcome a lifetime of conditioning against discussing the almighty salary.

Unfortunately, you’ll need to repeat it many times over the course of your career. Ah yes, friends, we’re talking about “The Ask.”

- Learn why we are so predisposed to fear asking our bosses for raises, even when we are long overdue.

- Memorize our eight best salary negotiation tips to take into every compensation negotiation.

- Learn the salary negotiation mistakes to absolutely avoid when asking for a raise.

- This article is for an employee or a job candidate looking to confidently and successfully negotiate their desired salary.

Before we get into this whole “template” thing, a disclaimer: obviously, every company, every job, and every person is different. Do we think you should use this template word-for-word? Actually, no.

Table of Contents

But we think it lays out exactly the information you should cover during your salary increase conversation with your boss. Think of it as a guide. Everyone has a different approach to asking for a pay increase. Add your own spin to it.

Our template works better when you clearly understand how asking for a raise works. Let's review some tips and some things to avoid.

Asking for a Raise: How to Prepare

We have two words for you: preparation and timing.

Before you even begin to craft your pitch for the pay raise you so deserve, you need to have the knowledge to back up your claims and to consider the mood and environment you’re walking into.

We want you to confidently walk into your (scheduled) meeting with your manager. We want to ensure you're prepared to present the most undeniable case for a raise. Here's how to prepare.

It helps if you set up a folder on your computer or in your email account to store all those notes from clients, your boss, and your colleagues in which you were commended for a great job.

We like to call this your "smile file," an organized place with examples of your great work.

This is why we think conducting regular self-evaluations is so important. These are regular reviews you do of your work in addition to any formal

annual review or

performance review you and your boss might have.

We love the informality of self-evaluation because you can track your accomplishments as they happen. However, a

better strategy is penciling in some time on your weekly calendar to review your work.

Why? Because your memory of the excellent work you did that week is better than three months from now.

2. Always Bring Data + Numbers

Here are some questions to ask yourself in your weekly evaluations:

- How has your company or department directly benefited from your work? Get specific.

- Did your team play a role in increasing sales by [X]% recently? Did you bring in [X] new clients? Is the team you oversee bigger than it was last year?

- Were you included in any important projects? What were they, and what role did you play? Who were the clients?

- When did you receive positive feedback over the past year (or even the past week, month, etc.)? What was it? Are there any trends in the feedback you receive?

When you are specific about the value you bring to your role, it's easier to

make your ask because you're "showing" and not just "telling" about your results.

3. Consider What You’ll Bring to the Team in the Coming Year (and Beyond)

You’re asking for this raise because you’ve demonstrated that you’ll go above and beyond in your current role, but your boss also wants to hear that you’re in it for the long haul.

4. Think About Why Your Boss Would Want to Give You More Money + The Time of Year

What’s in it for your boss?

Would giving you the raise ensure that they have a stable person in a management position? Would your raise prevent the possibility of you leaving and thus the turnover time and drawn-out application process they dread? Would your promotion include you being more client-focused?

Put yourself in your boss's shoes. What are their priorities?

What does success look like for them and your team/department? If you can tie your raise to reasons that are also good for your boss, that's a win-win.

Try the "Career-Only" Conversation

You can learn about your boss's goals by setting up a "career-only" conversation. This is where you learn about their future goals and learn how you fit into your boss's plans. This conversation doesn't need to include the mention of salary at all, which will take the pressure off you—but it will also help you get more focused on what you're going to ask for when the time comes to ask for a salary raise.

Another thing to consider when you're preparing to ask for a raise is the time of year. Some companies might have set times during the year to review current salary ranges, job titles, promotions, etc.

This is usually during an annual review; however,

David Buckmaster, Nike’s Global Compensation Director and author of

Fair Pay, says that it's too late to ask for a raise in that review. You want to start these conversations prior to it. We recommend three or four months prior if your company has a scheduled annual review each year.

This is because pay increases might involve many stakeholders—like your boss, human resources,

compensation analysts, and sometimes even recruiters. Compensation analysts will review salary data, the market rate, the cost of labor, and more, and then work with management to set new salary benchmarks and determine the market value for your job title.

Buckmaster says this is especially true at large organizations—and it's why you'll want to start thinking about your ask far in advance. If you're unsure if your company has an annual review process, you can ask Human Resources or your boss.

If you want to plant the salary seed early with your manager, try setting up a 1:1 conversation a few months before your annual review—but after your "career-only" conversation.

Introducing the "Career-Only" Conversation (aka the Prelude to the Raise!)

In this conversation, tell your manager you're thinking about your future, and you'd like to discuss "a path to [NAME OF JOB TITLE/PROMOTION] or at least compensation equivalent."

Or if you know you're not looking for a promotion and raise—just a raise. Try this:

"Thanks for sharing what your future goals are and taking the time to discuss how I fit into those. I know we have reviews in a few months and with my [RECENT ACHIEVEMENT/SOMETHING ABOUT WORK PERFORMANCE], I'll also be looking forward to revisiting my compensation. I'll start brainstorming some creative ways to [SOMETHING RELATED TO YOUR BOSS'S FUTURE GOALS/PLANS].

After you share that, let your manager talk. Once again, you're taking the pressure off making a direct ask, but you're letting your manager know that a raise is something you're looking for during reviews—and doing it early enough that they can make their own plans.

What if your company doesn't have an annual review process? How do you know when you can ask for a raise? The annoying answer is it depends, but a general rule is if it's been a year since your last raise or salary was set, you can ask to revisit your compensation. And, of course, showing proof of all your excellent contributions in the last year will greatly affect the timing.

The only exception to this "one-year rule" is if your role has changed significantly. Maybe you were hired for one thing, but your role has really morphed into something else. Or maybe because of Covid, you took on the work of a few other people.

If so, feel free to ask your boss to revisit your compensation sooner than the one-year mark.

5. Come Up With a Real Number

Next, you need to know the salary number you will ask for. This is the worst part, but it's why you're here.

Don't ask just one person. Try to understand the entire salary compensation of five people—men and women—and industry standards. We know it's weird to

ask people about money, but going straight to the source is really important for making an informed Ask. Here's an example of what you could say to start the conversation:

"Hi [NAME], I'm preparing to ask for a raise and a promotion, which would put me in a similar to yours. In preparing for my conversation with my manager and in the interest of salary transparency, I wanted to ask what salary you're currently earning. I want to make sure I am matching my experience with the correct rate."

Don’t forget that you’ll likely lose 10% or more of that number in the salary negotiation phase.

6. Get on the Calendar

At some offices, a

talk about a raise might come up naturally when discussing growth or new responsibilities your boss wants you to take on, but in most cases, you’ll want to make sure you’ve requested a set time to sit down.

The last thing you want is your boss checking her watch because she’s due in a meeting. So, put time on her calendar and give her a heads up that you'd like to discuss your role and current salary.

If you can meet in person, that's preferred; however, a video meeting also works well. We find that being able to read body language and tone of voice is helpful.

7. Don’t Just Practice, Record It

This may feel weird (and a little bit silly), but it will help you so much. Set your phone on a table and record yourself making your Ask. Force yourself to listen back to it. (It's hard to hear yourself, it really is, but it’s so worth it.)

Pay attention to body language, eye contact, face-touching, and any nervous filler words. Perfect your pitch

before you enter the room—oozing with confidence!

8. Go Through Your Ask With a Friend

Phone a friend—that's what friends are for. It’s one thing to do it in the mirror. Try having a friend sit in, and make sure they’re a friend who you know will give honest feedback. When you get that raise, take your friend to dinner!

DON'T Do These Things When Asking for a Raise

Now that we've gone through the best dos in asking for a raise, here's what to avoid.

It's a real balance. You want to

be confident, but also humble. You want to share impressive numbers, but make sure they're accurate. You want to boast about your work, but make sure not to take credit from others.

Timing is also extremely important, so make sure that you're paying attention to what is happening across the entire organization before scheduling your meeting.

Here are our not to-dos when asking for a raise.

1. Don't Focus on Personal Reasons When Asking for a Raise

Remember when we said expensive rent is not a good reason to ask for a raise? Still true. And you may feel

burned out and underpaid, but you’re going to need to let this go to have a useful conversation.

Money is money—there’s nothing emotional about it. Set those thoughts aside and go back to focusing on raw data.

2. Don't Ask for a Raise at a Terrible Time

Do some research on how your company works.

Did your company just go through layoffs? Were massive budget cuts just announced for your department? Are you on a hiring freeze? Did your boss just lose a huge client or have an unsuccessful presentation? Did your coworker who’s been there longer just ask for a raise too?

We also wanted to note that asking for a raise simply because you've been at an organization for a set of time (e.g., a year) is not really reason enough to ask. Yes, it is an accomplishment, but be prepared with deeper reasoning.

3. Don't Fudge Numbers or Take Undue Credit When Asking for a Raise

Most projects are done as a team, and your boss knows too well what kind of work you’ve been doing. Don’t say, “I’ve been working 70-hour weeks,” when we all know you haven’t been.

...Or that “You were responsible for increasing sales by 23% last year” when you worked with an entire team. Give credit where credit is due.

4. Don’t Sell Yourself Short When Asking for a Raise

This is not the time to be modest. People, and women in particular, tend to couch their requests in what Diana Faison, a partner with leadership development firm Flynn Heath Holt Leadership, calls “power robbers” such as “I feel like” and “I believe.”

What to Say When Asking for a Raise [The Template]

Asking for a raise is about good storytelling. Really, though, it needs situation, conflict, and resolution. The resolution part is you getting the raise—get it?

The easiest way to do that is to cover the Who, What, Where, Why, When, and How.

G: Give Background Info

I: Introduce Why You’re Awesome

M: Make Your Case Research-based

(This is where all that research comes in!)

M: Make the Ask

E: End With a Bang

Once you have the template, fill it in with the information you collected above and practice it—a lot. One of the best pieces of salary advice we ever got was once you make your Ask, be quiet. Let the person on the other side respond.

When we are nervous we might feel the need to fill the space.

You're making a confident Ask, so let there be a little silence while your boss considers everything.

How to Ask for a Raise: An Example Script

"Thanks for taking the time to meet with me today. As you probably know, I'm been here for three years, and I've been thinking a lot lately about how I see myself growing within our company and team.

As the Editorial Manager, I've taken on responsibilities as our team has evolved. Most recently, I led the website revamp and cross-collaborated with the product, tech, and design teams to launch a new site under budget and in six months. I also created an online onboarding program for new writers, saving our team 20 hours a month on average in repetitive tasks. Now that I am managing a team of writers and working with marketing to increase our website visitors, I'd like to revisit my salary to reflect my work and contributions.

The positive feedback I've received in our weekly meetings has also encouraged me to do some salary research. Based on people in similar roles and with similar responsibilities, I've found that an annual salary increase of 18% is commensurate with my skills.

Since joining this team and company, I've continued to expand my skill set and responsibilities, and I'm looking forward to continuing to put that time and effort into our long-term success here. With an increase in compensation, I'm confident I can tackle new projects and continue to benefit the company.

Are we able to revisit my compensation at this time?"

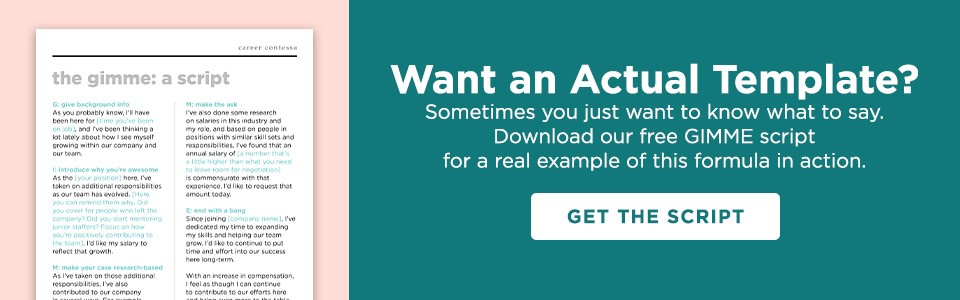

Want a printable version of this template and script? You can download it for free right

here.

What to Do After Asking for a Raise

Stop talking. That's right—make your ask and then stop talking. When we get nervous, we have a tendency to go on and on, but we want you to look confident and secure in your ask.

Next, chances are your boss won’t be able to say yes or no right away. They’ll probably ask you for some time to discuss with other supervisors and/or review your information.

Thank them for their time and give them some space, but make sure to touch base with them if you haven’t heard back after a full week.

What to Do if They Say "No" to Your Raise Request

You should also be prepared for when the answer is

no. If that’s the case, consider what

other company perks you could ask for. Extra vacation days?

A four-day workweek? Better benefits? Often, these perks are easier for employers to provide than monetary compensation.

Real-Life Example of Raise Rejection

How I Handled a Raise Rejection from Career Contessa Coach, Marnie LemonikWhat: I took my raise request directly to the compensation team after my manager initially told me no so I could get more clarity and make a case for myself directly.

How: I asked my boss if there were any additional conversations I could have on my side to take the additional work off of her plate and really take ownership of my raise request. This conversation is crucial as you don’t want anything to come off as going around your boss’ back or not accepting the rejection.

Outcome: Once I connected with the compensation team, my compensation manager caught an internal error that was remedied, and I received a few extra thousand dollars. While it wasn’t the original amount I had asked for, it felt good knowing that I was able to dig into the request at the source with my manager's blessing.