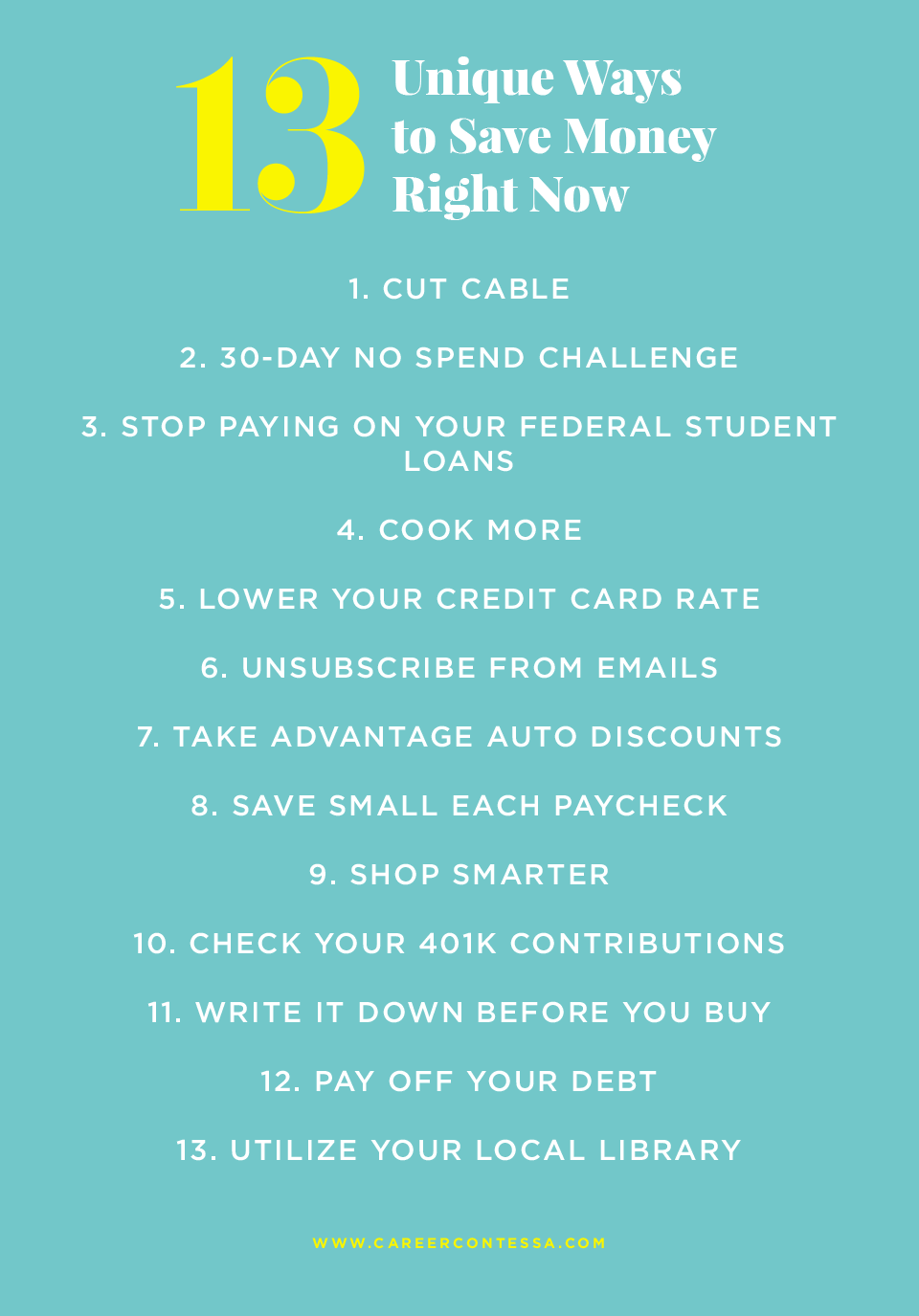

Money is a hot topic, and we're all looking for unique ways to save money right now.

Whether you're trying to save it or make it, the state of, well, everything, has money on the top of our minds. If you're looking for ways to build up your emergency fund or pinch your pennies right now, try these 13 tips.

1. Cut Cable

Cutting your cable can save you a lot. Switch to a subscription service like Netflix, Hulu, or Amazon Video. Chances are you already use at least one of these services anyway, so there won’t be an additional cost to you.

2. 30-Day No Spend Challenge

Challenge yourself to not spend any money, except on essentials like groceries, rent, and utilities, for the next 30 days. Hold yourself accountable by encouraging your partner or roommates to join. If you've been finding yourself adding lots of items to your cart online, this could lead to savings.

3. Stop Paying on Your Federal Student Loans

One of the best ways to save money is to pay off debt. But if you're hurting for cash right now, halting your federal student loan payments could help you make your rent payment. As a part of the

CARES Act, federal student loans have been placed in

forbearance with zero percent interest from March 13, 2020 to September 30, 2021. This is a great option to save money in the short-term.

4. Cook More

Save money by swapping your lunches out with leftovers and sandwiches. Keep the savings coming by cooking dinner more often to cut back on the cost of takeout and delivery. Experiment with new recipes or start a fun cooking challenge with your partner or roommates. It can spark friendly competition with a tasty end result.

5. Lower Your Credit Card Rate

Lowering your credit card rate can be as easy as calling your provider. Negotiate for a better rate by leveraging your good payment history and credit score. If your provider isn't willing to lower your rate, explore balance transfer offers. Transferring your existing balance to another card can help you save on interest for a set period of time, so you can focus on paying off your debt or saving the extra cash. If you're struggling to make your current payment as a result of COVID-19,

reach out to your provider to discuss your options.

6. Unsubscribe From Emails

How many emails do you get a day from retail companies offering their latest promotion and telling you about the deal you absolutely cannot miss? My guess is too many. Take 15 minutes to unsubscribe from these emails so you'll be less tempted to buy things you don't need. Buying the latest trend won't be top of mind when you don't get the emails to remind you. Your wallet and your inbox will thank you.

7. Take Advantage of Auto Discounts

Take the time to contact your auto insurance provider about what discounts, if any, are available to you. Due to the pandemic, many companies are offering flexible options.

Geico, for example, is still offering "flexible playment plans and/or special payment plans" for customers who may be feeling the effects of the pandemic. And while you're at it, see if you can lower your premium as a result of save driving or longevity with the company. It never hurts to ask.

8. Save Small Each Paycheck

Even if money is tight, you can

find a few dollars to save. Try setting aside $10 or $20 in your savings every time you get paid. It may seem small, but it's the first step to save for emergencies and unexpected expenses. Make it even easier by setting up an automatic transfer at your bank from your checking account to your savings account on payday. You always have cash when you pay yourself first.

9. Shop Smarter

This is a no brainer. Groceries add up, especially if you're buying more than usual because you're spending more time at home. Shopping discount stores and generic brands help you save big on your grocery bill. Hold off on the Whole Foods runs for now; you can grab your veggies elsewhere. Bonus tip: make a grocery list before you hit the aisles. Ensuring you're only buying what you need will keep your bill at bay.

10. Check Your 401k Contributions

Ideally, you set up your

401k contributions to automatically withdraw from your paycheck and never think about it again. But when times get hard, check to see if you can cut back on your contributions for a short time. An extra few percentage points can make all the difference in your budget right now. To continue getting the most out of your retirement, make sure you're contributing at least enough to meet your company match.

11. Write It Down Before You Buy

If there's something you've been eyeing to purchase, write it down. Whether it's a new pair of shoes, a planner, or household item, writing it down and waiting a few days can help you decide if you need the item or if it's just a nice to have. This trick helps you not make impulse purchases. If, after a week or two, you're still thinking about the item and you can't live without it, go ahead and make the purchase.

12. Pay Off Your Debt

While it costs you money now,

paying off debt will save you money in the long run. In the short term, you'll save on interest by lowering your principal balance, and once you pay off your debt, you'll save the entire payment. If you're looking to save on your monthly minimum payment or interest rate immediately, try refinancing your student loans.

13. Utilize Your Local Library

If you've been

catching up on your reading and find you've been dropping the big bucks on books, don't forget about your local library. Plus, most have online services where you can rent ebooks or audiobooks. This saves you money and gives you access to thousands of titles that will keep you busy.