Trying to save money? Too bad you're probably spending it in other places without even realizing.

Have you ever taken a serious look at your spending and noticed any trends or habits that you weren't too happy about? You're not alone. I recently came across a really insightful

personal finance study by Hloom.com that asked 2,000 people across the United States to share their two cents (pun intended) about the various ways they waste money and the results were very interesting!

While the study was done across different categories and age groups, today I'm focusing on the ways

women are wasting their money and providing some Clever Girl tips on how to curb this wastefulness!

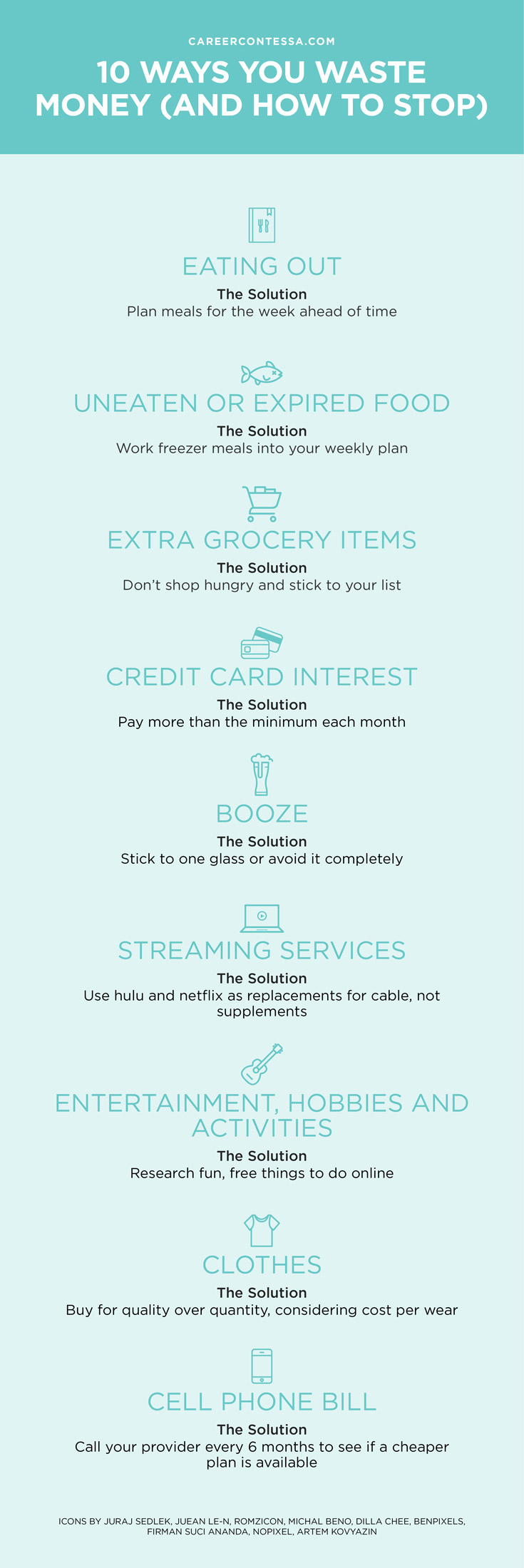

1. Eating out

Unsurprisingly, this tops the list. Based on the study, 70 percent of women admit to wasting money on eating out—A.K.A. most of us!—and it's no surprise because the majority of us tend to eat out at work.

One way to curb this is by looking at your schedule ahead of time and planning accordingly. For instance, if you have a dinner on one night you may want to consider taking breakfast and lunch to work so that you are not eating three meals out in one day. Also eating out for lunch is usually cheaper than dinner so you may want to consider planning lunch dates as opposed to dinners.

Another way to curb eating out so much is by meal planning. Pinterest has tons of really awesome meal planning ideas that you can change up each week so you never have to take a boring lunch to work ever again. And you can create meal planning challenges with your coworkers, too. The great thing about meal planning is that it helps you eat better, since you are more likely to make better choices when planning ahead.

2. Uneaten or expired food

Ever find that you go to the grocery store, buy all this food, and then end up eating out so much that most of it goes uneaten or ends up expired? Again, your solution here is meal planning. Also when you plan out your meals you'll get a better idea of how much you should be buying and what your leftovers will be like, so you can freeze food instead of letting it go to waste. When you freeze food, it lasts well over the expiration date, leaving you more money for everything else.

3. Grocery items

Can we say "meal planning" again? You want to plan out your meals for the week before you head to the grocery store. Also make sure to go to the grocery store with a full belly and with a list of items to buy, so you don't get sidetracked by that smell of baking bread wafting from the corner. Better yet, take advantage of online grocery shopping or subscription services if possible. Sometimes the $5 or $10 delivery fee is still less than you'd spend on those extra unplanned items that sneak into your cart each time you visit the grocery store.

4. Credit card interest

Credit card interest is how the credit card companies make money and how you stay in debt. Ever feel like you aren't making a dent in your debt even though you are making payments religiously every month? Well, making only the minimum payments on your credit debt will do this. The way to combat it? Pay more than the minimum each month. Pay as much as you can towards your credit card balances every single month until you can eventually pay them off. In other words, get aggressive. See my post on

how to pay off debt using the snowball method for some more tips.

5. Booze

Alcohol costs a lot of money, especially at restaurants and bars. The markup is ridiculous—actually, it's more than ridiculous, it's crazy. My advice? If you are seriously trying to save money but need to meet someone for a drink, stick to one glass or avoid it completely.

6. Streaming Services

Streaming services make sense if they replace something else, for instance, if you plan on Netflix replacing your cable subscription. However, if you are paying for streaming services just to have them or only to watch certain shows and you find yourself with cable plus Netflix plus Hulu etc., then this really is a waste of money. It's time to cancel some of those services.

7. Entertainment and 8. Hobbies and Activities

I'm lumping these together because they sort of fall into the same category—both unnecessary expenses that add up fast. Add in kids and the costs can skyrocket. To save money, think of free things to do, Pinterest is a great "go to" for me (can you tell?) because it has tons of ideas—just search the word "free" and you'll find more options than you'll have time for.

9. Clothes

Trends come and go—so unless it's a staple piece, clothes really are not a worthwhile investment. That being said, buy quality over quantity, plan out your wardrobe and think about "

cost per wear" when making a purchase. So spend big on the boots that'll withstand a full winter of wintry conditions, not the summer music festival outfit you'll wear twice.

10. Cell phone Plans

Have you called your cell phone company to find out if there's a cheaper plan lately? Service and data rates are so competitive these days, there's always some special offer going on. Plan to call every six months or so to see if you can get a better rate. It never hurts to try.